- #ADDITIONAL LIVING EXPENSES RECEIPT LODGING REGISTRATION#

- #ADDITIONAL LIVING EXPENSES RECEIPT LODGING PLUS#

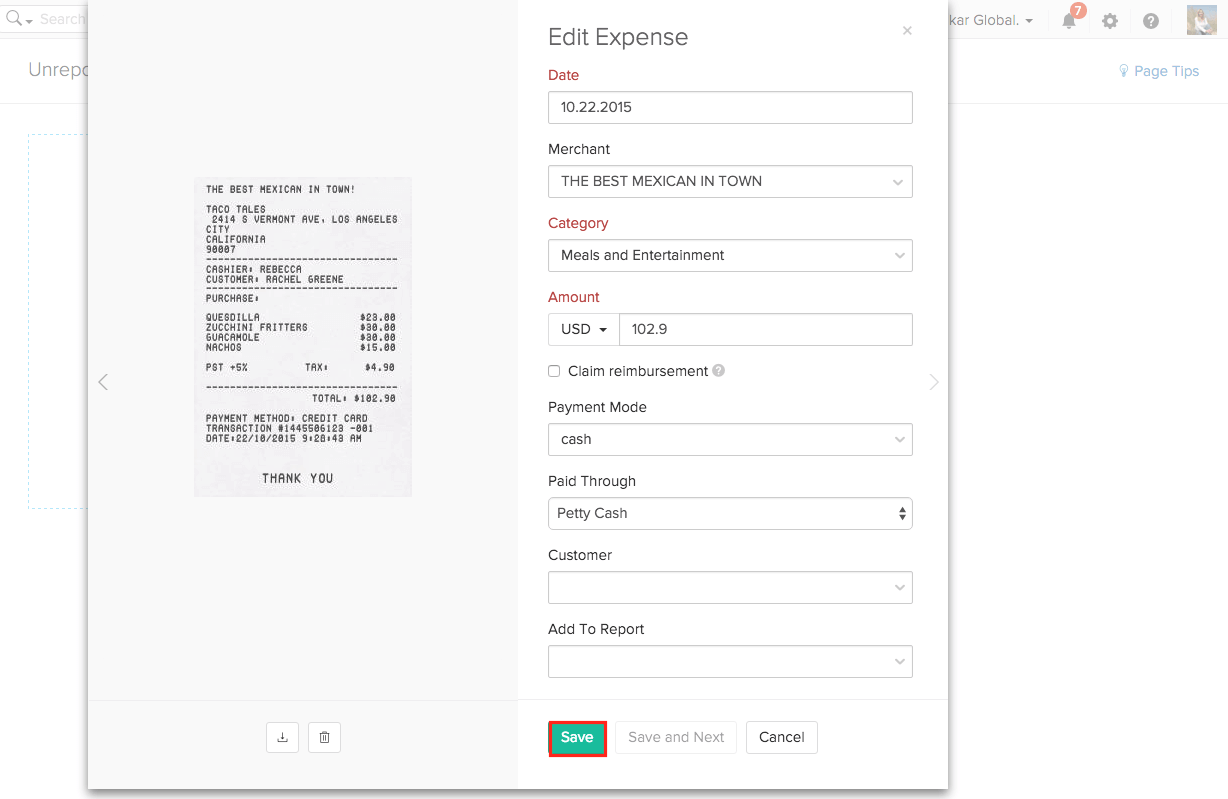

Debit card numbers (except the last four digits).Credit card numbers (except the last four digits).Obscure or remove any sensitive or confidential information, including:.Be sure to attach a copy of the currency conversion page from the website when submitting for reimbursement, or notate the US dollar amount on all required receipts. If you traveled internationally, convert foreign currency to US dollars – refer to your credit card statement or look up rates effective on the purchase date at.For guidance on additional restrictions, contact your research administrator or department business officer. If you are claiming expenses on a flat per-diem rate, receipts for meals and lodging are not required, unless actual expenses exceed the maximum daily limit for the location.įor all other expenses not referenced here, receipts of $75 or more (i.e., ground transportation, interpreter services, etc.) are required. Some fund sources may require receipts regardless of dollar amount. If the amount above the maximum daily limit is not justified, you will only be reimbursed up to the maximum daily limit Costs in the location were unusually high, perhaps due to a sell-out national sporting event or to an unexpected airport closure.The conference rate for lodging is higher than the maximum daily limit.

Examples of special circumstances that may support reimbursement above the daily limit amount include:

#ADDITIONAL LIVING EXPENSES RECEIPT LODGING REGISTRATION#

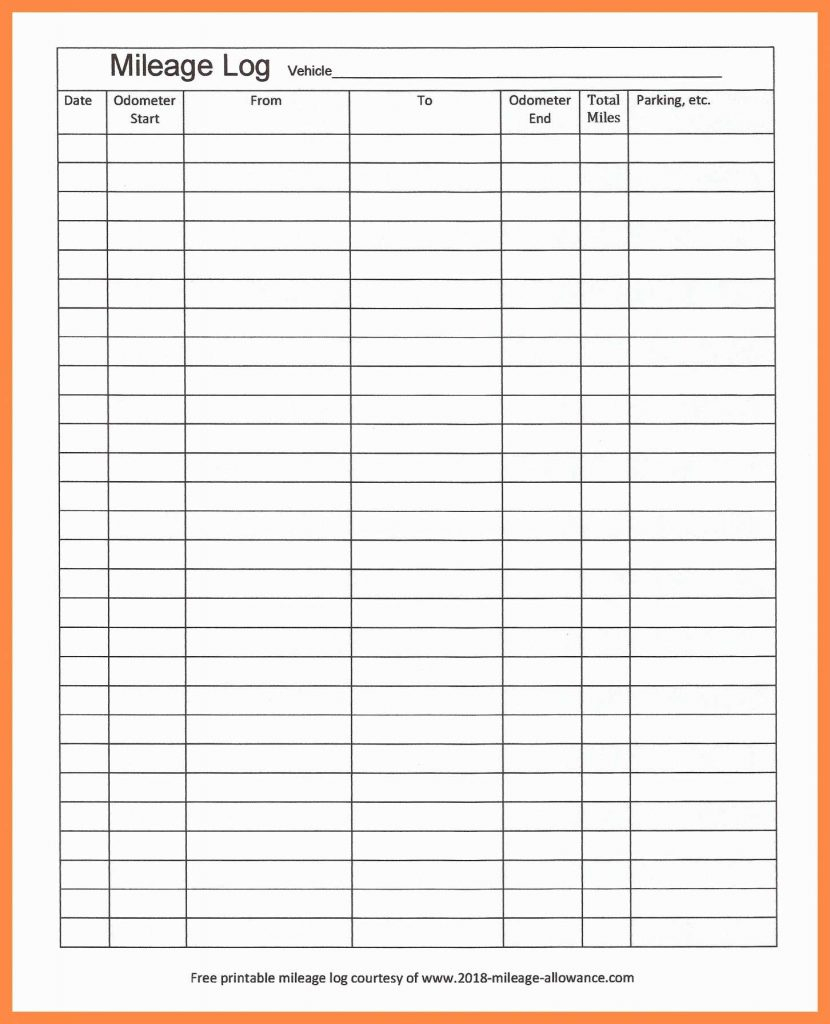

Receipts for airfare, lodging, conference registration and car rental expenses regardless of amount.You will only be reimbursed for mileage if your relocation requires you to drive more than you normally would.Required Documentation for Domestic Trips It’s very important to note that the coverage is for “additional” expenses, so if you usually spend $1,500 a month for food (groceries), and it costs $3,200 while you are displaced because you need to order in,, you will be reimbursed $3,200 minus the $1,500you would have spent if you were at home.

#ADDITIONAL LIVING EXPENSES RECEIPT LODGING PLUS#

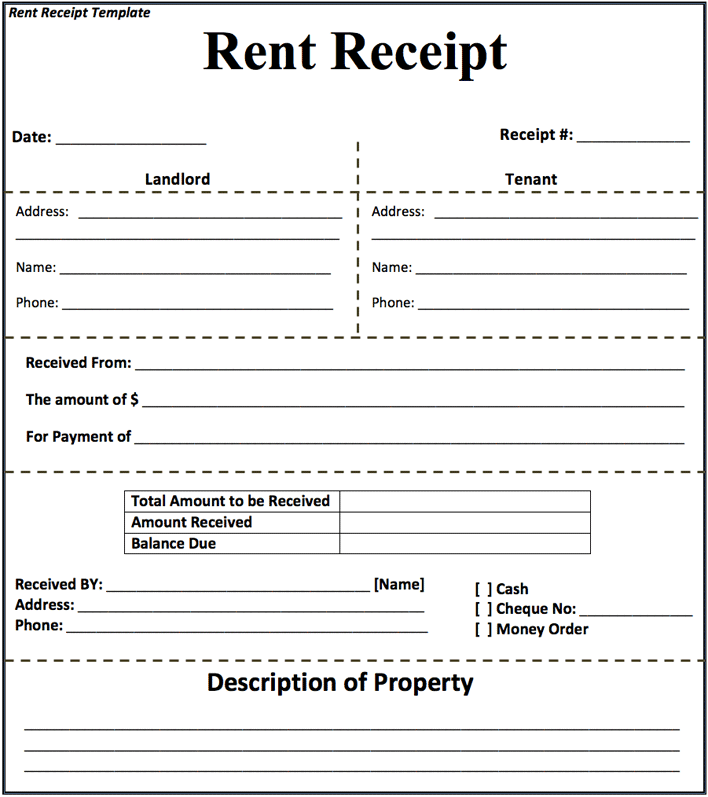

If you need to leave your home due to an insured loss or evacuation order, your additional living expense coverage will typically reimburse you the cost of a short-term rental or hotel accommodations, plus meals, laundry, and possibly even pet boarding, furniture storage and mileage put on your vehicle. It’s meant to pay for comparable accommodations to what you are used to, so it likely won’t cover a five-star hotel or meals at a five-star restaurant. This coverage is usually limited to a maximum of 20 – 30% of the replacement value of the home, as listed in the policy, or 12 months.

Most Ontario home insurance policies provide three categories of ALE coverage:Īdditional living expenses: This helps to reduce the financial burden related to living away from your home while repairs are being made by covering expenses you normally wouldn’t have such as:

0 kommentar(er)

0 kommentar(er)